Invisalign is one of the hottest products of the year thanks to teens and adults who want straight teeth without metal in their mouths.

The shift to clear aligners has powered Align Technology (ALGN), the company behind Invisalign, to a record year. Align’s value has nearly tripled, making it the top performer on the S&P 500. It’s worth close to $20 billion.

“Braces are no longer a right of passage for teens,” said Jeff Johnson, an RW Baird analyst. Invisalign is “quickly moving into the mass adoption part of the market.”

More than a million teens across the globe have ordered Invisalign, Align announced in November. Five million people have purchased the treatment, which costs anywhere between $3,000 – $8,000.

Align sales have grown two years in a row, and its last quarter was the best in the company’s 20-year history.

Orders among teens spiked to nearly 70,000 this past quarter, a 46% rise compared to the same period last year. Credit Suisse analyst Erin Wright called the jump “momentous.”

The company’s strategy to expand internationally over the past several years — especially in China — has fueled growth. China became Invisalign’s second-biggest market behind the United States for the first time last quarter.

Align has also aggressively targeted both patients and doctors in a push to disrupt the orthodontic industry.

“They make no qualms that they would like to be a major form of orthodontic treatment,” said Dr. Olivier Nicolay, a professor at NYU’s College of Dentistry.

Align has ramped up advertising spending 60% this year as part of its effort to highlight the product’s aesthetic and lifestyle advantages over braces to teens and their parents.

“You can pull them out to eat the food that you want or play a sport or play a musical instrument,” CEO Joe Hogan told CNNMoney in an interview. “You can live the life that you want to live.”

Product advancements and Align’s efforts to train a network of more than 125,000 orthodontists and dentists around the world have also expanded its reach.

“There’s been an evolution of this technology. We’ve invested a significant amount of money,” said Hogan. “Years ago we weren’t capable of doing a lot of the cases that are out there.”

Once skeptical that clear aligners could deliver the same results as wires and brackets, orthodontists are now more comfortable putting patients on the treatment.

“Orthodontists are no longer scared of it,” said Dr. Nicolay. “Invisalign has become an accepted procedure for adults and for adolescents.”

Dentists are also eager for new revenue drivers to offset a sluggish recovery in patient levels a decade after the recession, noted William Blair analyst John Kreger.

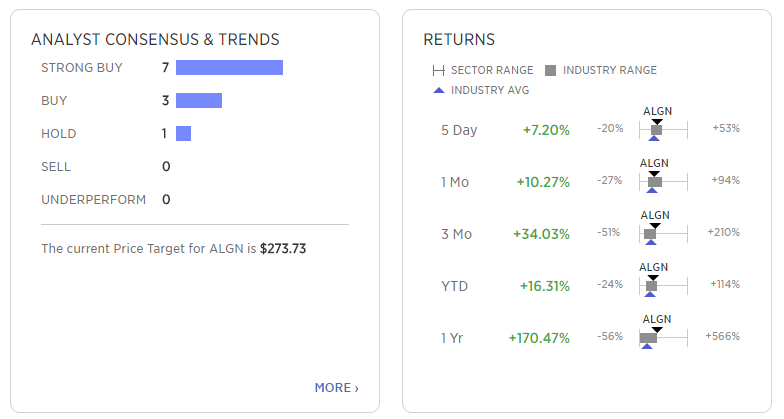

With few major competitors looming, a tight grip on the dozens of patents that go into producing clear aligner technology and strong brand recognition, Align’s looks poised to continue its climb into next year and beyond.

And the untapped teen orthodontic market has analysts increasingly bullish about the company’s long-term prospects.

Teens account for roughly three-quarters of the 10 million orthodontic cases each year, but only 3% of them use Invisalign.

“We see no reason why it couldn’t surpass 10% in the next five years,” predicted Kreger.