Technology companies are the profit-leading stocks in the market today!

While trendy stocks may come and go with temporary appeal, there’s no substitute for soaring profits when investors scramble to gain a foothold in new opportunities within the tech sector.

Investors have witnessed astronomical moves in technology titans that have revolutionized and transformed our lives as the science behind the platform becomes exponentially “smarter”.

Right now, the most explosive profit opportunity is concentrated in AI technology integration, and the way communication is facilitated between a network of devices to save time, money and even lives.

It’s in this area where One Groundbreaking Company has emerged as the front runner!

SKYX Platforms Corp. (NASDAQ: SKYX)

SKYX Platforms Corp. (NASDAQ: SKYX) is a breakout tech superstar experiencing astounding sales growth with the launch of their SkyPlug Smart platform by making homes and buildings safer and smarter.

2023 Sales Explosion 159,000% increase vs 2022

SKYX reported revenue for the first 3 Quarters in 2023 of $36.6M compared to the same period last year of just under $23,000. This represents year-over-year growth of over 159,000%!

SKYX fits squarely in the category of companies that have exploded onto the rising tide of the smart technology revolution.

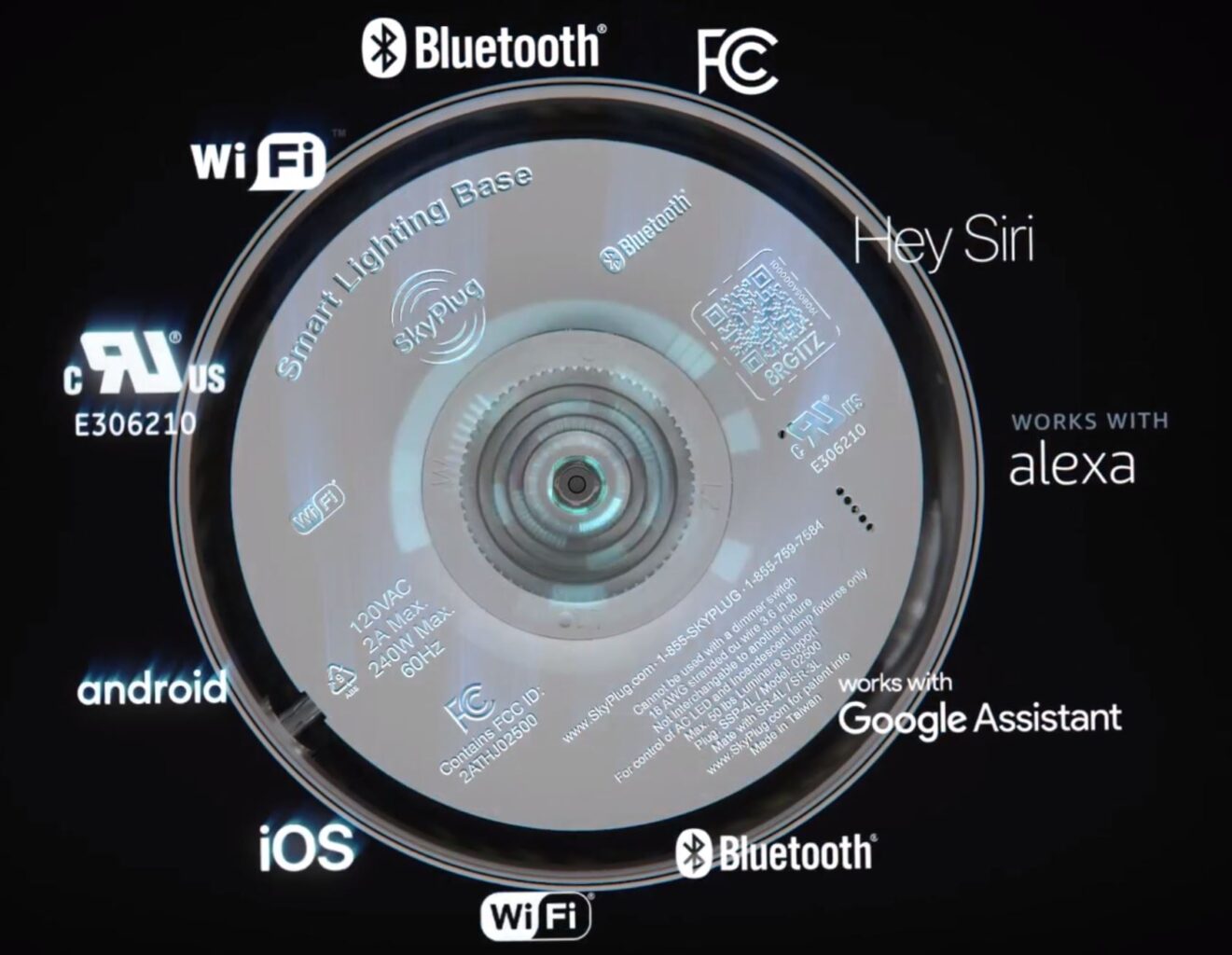

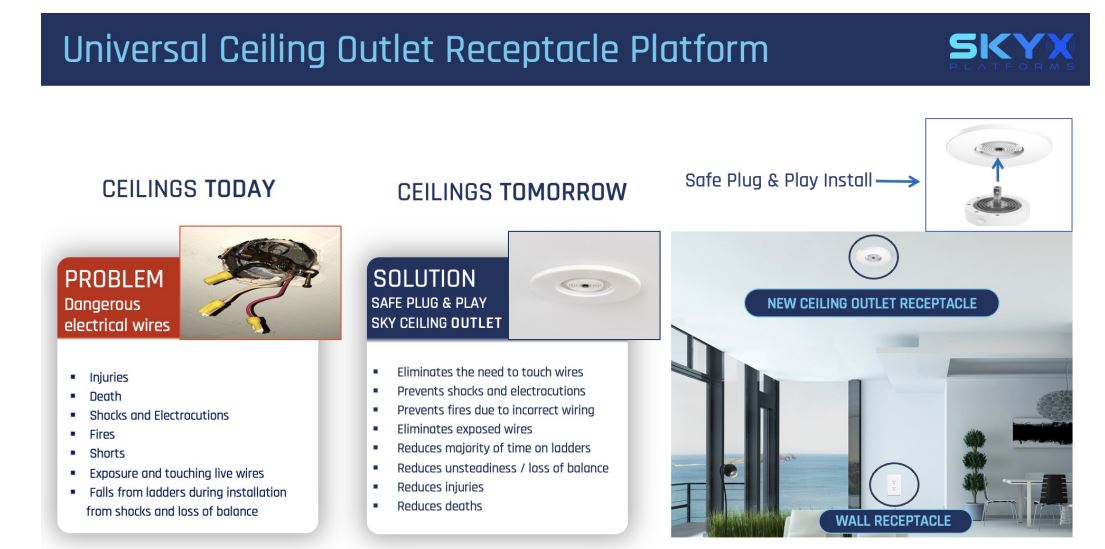

SKYX’s SkyPlug Smart Platform is “The New US Safety Standard For Ceilings” which eliminates the need to touch hazardous wires in a ceiling’s electrical outlet box. SKYX’s advanced-safe smart platform technologies enable light fixtures, ceiling fans and other electrically wired products to be installed safely and plugged-in into a ceiling’s electrical outlet box within seconds.

The familiar wall plug experience, now on your ceiling. Plugging in fixtures safely within seconds.

The Massive Sudden Interest in SKYX’s SkyPlug Smart Technology

When investors get wind of revolutionary technology, the results can be dramatic! Many of the market’s sizzling performers are heavily concentrated in the tech sector as worldwide dominance puts these companies on the fast-track to super-charged sales and profits.

SKYX’s SkyPlug system has the extraordinary ability to transform any home or building by combining an easily installed ceiling lighting system with cutting-edge features integrated into the Plug & Play platform.

SKYX’s Plug & Play Platform : A master-level achievement

Game-changing technology of this caliber places the power of SKYX’s SkyHome App directly into the hands of the user to control not only an assortment of built-in lighting features but also a variety of smart-home automation devices based on AI technology, such as: Amazon Alexa, Google Assistant, Siri, Android, and iOS.

SKYX SkyPlug smart features include control of light fixtures and ceiling fans via the SkyHome App, through WIFI, Bluetooth Low Energy and voice control. It allows scheduling, energy savings eco mode, dimming, back-up emergency light, night light, light color changing and much more.

SKYX has already reshaped an entire industry by bursting onto the scene with their 2023 sales explosion combined with sizable product orders and backlog for the prior and current quarter this year.

SKYX’s breakthrough technology has quickly transformed a consumer sector that has laid dormant for more than 20 years! As an AI/Home Solutions integrated standout, SKYX has redefined the science behind their success.

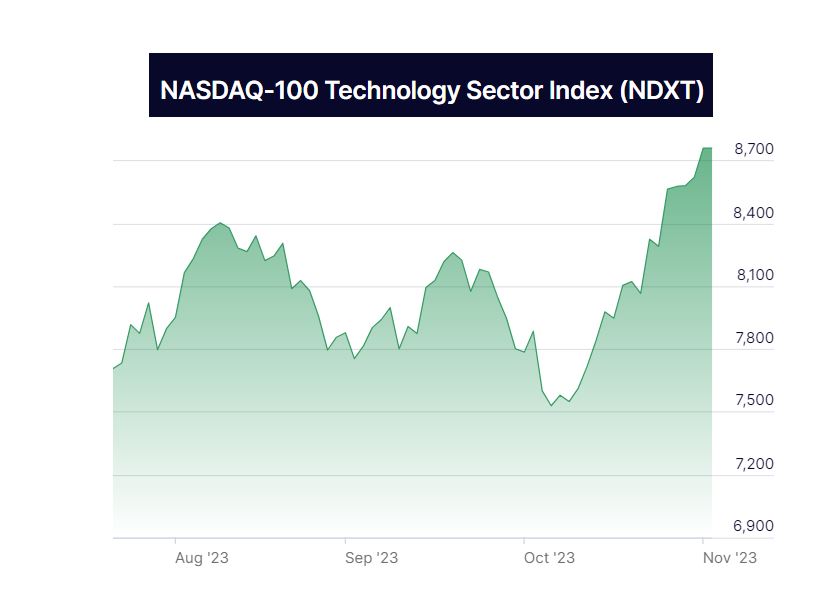

SKYX’s overwhelmingly successful product launch in their 2023 breakout year is the definition of perfect timing as the NASDAQ Tech Sector is on a rampage!

The enormous growth wave of App Integration has spurred the booming intersection of AI and Smart Home Technology!

WILD RIDE: The index graph representing a basket of NASDAQ Tech Stocks, usually very volatile, has been on a tear lately.

SKYX FILES WITH NEC FOR SAFETY STANDARDIZATION

SKYX (NASDAQ:SKYX) recently announced that it has filed an application for a mandatory safety standardization with the National Electrical Code (NEC) for its ceiling outlet receptacle platform for homes and buildings.

A mandatory standardization of SKYX’s ceiling outlet platform would enable a robust, safer plug-and-play ceiling installation of light fixtures and ceiling fans without a need to touch electrical hazardous wires and would significantly reduce fires, ladder falls, electrocutions, injuries and deaths due to hazardous electrical wire installations.

SKYX’s code team is led by Mark Earley, former head of the National Electrical Code (NEC), and Eric Jacobson, former President and CEO of the American Lighting Association (ALA). As part of the mandatory application, SKYX’s code team has submitted significant supporting data regarding hazardous incidents that occur due to electrical wire installations.

After years of rigorous standardization progress, SKYX’s management and code team strongly believe that it has met the necessary safety conditions and has significant hazardous data support for a compelling case for its ceiling outlet receptacle to become a mandatory safety standardization for ceilings in homes and buildings.

The Power of the Platform: The Future is Now

Beyond SKYX’s technological sophistication is the product revenue propelled by ownership of Nearly Half of all U.S. Lighting Websites!

SKYX website portfolio now spans 64 websites for lighting and home décor products – including most leading U.S. lighting brands.

The Company’s intellectual property portfolio is armed with a total of 77 issued and pending patents, 23 of which are issued patents covering SKYX’s advanced and smart technologies.

By maintaining control of the products, patents, and technology, SKYX drives the revenue stream with both hands on the wheel.

Rather than being burdened by third-party costs, or bloated R & D budgets that can slice margins razor-thin, technology first-movers specializing in life-changing and life-saving achievements to full retail product distribution are low maintenance and streamlined — all the way to the bottom-line!

Genius is a tricky thing to define, but when you come across a company flexing their muscle right from the outset, you know it when you see it.

ON THE BRINK OF A BREAKOUT

It has never been more apparent than in the last few years that omitting quality, undervalued, up-and-coming technology players from your investment selections is a sure sign of an unbalanced and underperforming portfolio.

SKYX is one of the best-orchestrated consumer products plays we’ve seen in years, and because their technological wizardry is truly emerging as a ‘must-have’, the rate of growth can be breathtaking.

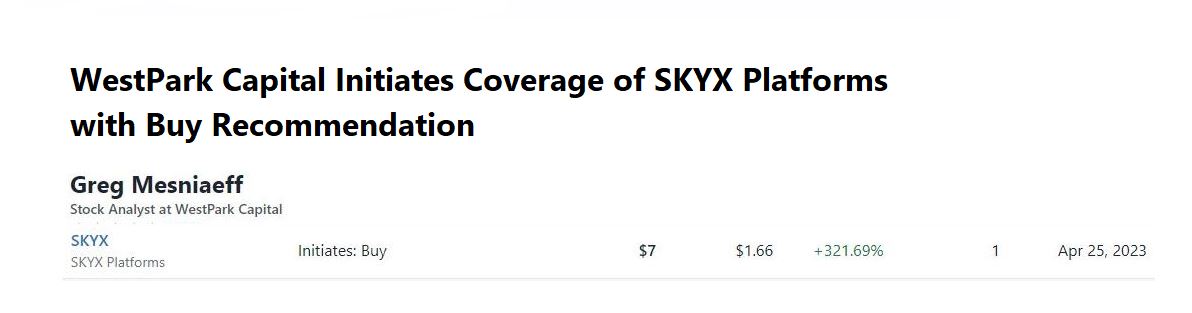

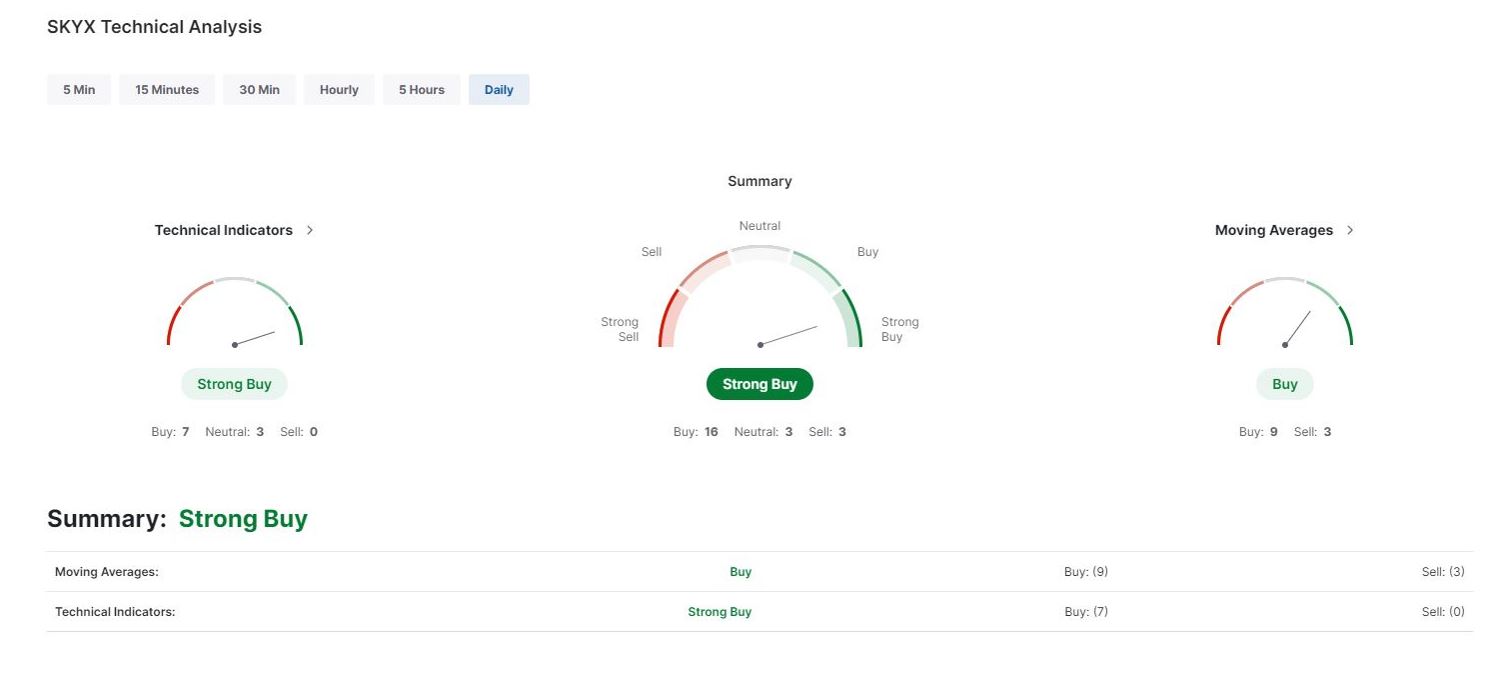

SKYX is getting picked up on the radar screens of Wall Street Analysts who can no longer ignore their rapid development. A Buy Recommendation for SKYX has been initiated with analyst coverage from WestPark Capital along with a Target Price of $7. This represents over 300% stock gains from SKYX’s current trading level.

SKYX, as evidenced by a chain of consummated deals, demonstrates a wealth of expertise in a vital area so heavily relied upon by an industry expanding globally at an unprecedented pace.

With revenue exploding and products that are tested and produced in accordance with world-class standards, the strength of the Company is only just beginning to reflect in the overall market tempo.

Uncovering Wall Street gems and profiting from special situations is all about timing. Learning of such opportunities in the earliest stages of growth vastly improves the leverage of your position. As we’ve seen now more than ever, accumulating positions in the streaking NASDAQ tech sector enables profit-minded investors to build real wealth. The key is to jump in before the stock gathers momentum, hits its stride, and never looks back.